What is Cicli&Mercati

The publication of Directive 2014/65 / EC (so-called MiFID 2), which took place on June 12, 2014, represents an important step, albeit not definitive, in the complex process of reviewing the European regulations on financial markets and investment. The Directive became effective in Italy on the January 3rd 2018.

MiFID 2 is among the Directives with the greatest impact on financial intermediaries (Banks, SIMs, SGRs, etc.) as it introduces important and significant changes in the European financial market with the aim of developing a single market for financial services in Europe, in which transparency and investor protection are ensured.

It is precisely in this regulatory context that Cicli & Mercati is located: an independent investment research hub, dedicated to the application of statistics, quantitative models and mass psychology to financial markets. Our goal is not market timing itself, but rather risk management within the study of efficient strategies and products. This is how we approach markets: we study the signals that suggest that it is time to increase or decrease exposure to the market, depending on the relationship between risk and probable reward.

Cicli&Mercati is a hub made up of professionals, award-winning on a personal and corporate level, who have been active for decades in the field of operational financial analysis and consultancy for institutional and private investors.

We work with quantitative (Portafogli Modello) and qualitative methods (statistics, cycle analysis, proprietary indicators, etc.) to enable everyone – from the trader to the investor to the professional in the sector – to implement their own know-how and their own autonomousdecision-making process.

Our tools are experience and our way to analyze numbers and statistics. Our only target is the constant improvement of the knowledge and awareness on the financial markets of all those who approach this world.

The publication of Directive 2014/65 / EC (so-called MiFID 2), which took place on June 12, 2014, represents an important step, albeit not definitive, in the complex process of reviewing the European regulations on financial markets and investment. The Directive became effective in Italy on the January 3rd 2018.

The publication of Directive 2014/65 / EC (so-called MiFID 2), which took place on June 12, 2014, represents an important step, albeit not definitive, in the complex process of reviewing the European regulations on financial markets and investment. The Directive became effective in Italy on the January 3rd 2018.

MiFID 2 is among the Directives with the greatest impact on financial intermediaries (Banks, SIMs, SGRs, etc.) as it introduces important and significant changes in the European financial market with the aim of developing a single market for financial services in Europe, in which transparency and investor protection are ensured.

It is precisely in this regulatory context that Cicli & Mercati is located: an independent investment research hub, dedicated to the application of statistics, quantitative models and mass psychology to financial markets. Our goal is not market timing itself, but rather risk management within the study of efficient strategies and products. This is how we approach markets: we study the signals that suggest that it is time to increase or decrease exposure to the market, depending on the relationship between risk and probable reward.

It is precisely in this regulatory context that Cicli & Mercati is located: an independent investment research hub, dedicated to the application of statistics, quantitative models and mass psychology to financial markets. Our goal is not market timing itself, but rather risk management within the study of efficient strategies and products. This is how we approach markets: we study the signals that suggest that it is time to increase or decrease exposure to the market, depending on the relationship between risk and probable reward.

Cicli&Mercati is a hub made up of professionals, award-winning on a personal and corporate level, who have been active for decades in the field of operational financial analysis and consultancy for institutional and private investors.

We work with quantitative (Portafogli Modello) and qualitative methods (statistics, cycle analysis, proprietary indicators, etc.) to enable everyone – from the trader to the investor to the professional in the sector – to implement their own know-how and their own autonomousdecision-making process.

Our tools are experience and our way to analyze numbers and statistics. Our only target is the constant improvement of the knowledge and awareness on the financial markets of all those who approach this world.

The publication of Directive 2014/65 / EC (so-called MiFID 2), which took place on June 12, 2014, represents an important step, albeit not definitive, in the complex process of reviewing the European regulations on financial markets and investment. The Directive became effective in Italy on the January 3rd 2018.

MiFID 2 is among the Directives with the greatest impact on financial intermediaries (Banks, SIMs, SGRs, etc.) as it introduces important and significant changes in the European financial market with the aim of developing a single market for financial services in Europe, in which transparency and investor protection are ensured.

It is precisely in this regulatory context that Cicli & Mercati is located: an independent investment research hub, dedicated to the application of statistics, quantitative models and mass psychology to financial markets. Our goal is not market timing itself, but rather risk management within the study of efficient strategies and products. This is how we approach markets: we study the signals that suggest that it is time to increase or decrease exposure to the market, depending on the relationship between risk and probable reward.

Cicli&Mercati is a hub made up of professionals, award-winning on a personal and corporate level, who have been active for decades in the field of operational financial analysis and consultancy for institutional and private investors.

We work with quantitative (Portafogli Modello) and qualitative methods (statistics, cycle analysis, proprietary indicators, etc.) to enable everyone – from the trader to the investor to the professional in the sector – to implement their own know-how and their own autonomousdecision-making process.

Our tools are experience and our way to analyze numbers and statistics. Our only target is the constant improvement of the knowledge and awareness on the financial markets of all those who approach this world.

What we can do for you

Strategies

7 models for trading with ETFs and stocks, best picking and stock picking, for aggressive and dynamic profiles. The model allows you to choose the asset classes and securities with the best technical risk / return prospects within large baskets of reference.

→ Bond

→ Italia Big Cap

→ Italia Mid Cap

→ Master Balanced

→ Master Puro

→ Megatrend

→ US Selection

7 models for trading with ETFs and stocks, best picking and stock picking, for aggressive and dynamic profiles. The model allows you to choose the asset classes and securities with the best technical risk / return prospects within large baskets of reference.

→ Bond

→ Italia Big Cap

→ Italia Mid Cap

→ Master Balanced

→ Master Puro

→ Megatrend

→ US Selection

7 models for trading with ETFs and stocks, best picking and stock picking, for aggressive and dynamic profiles. The model allows you to choose the asset classes and securities with the best technical risk / return prospects within large baskets of reference.

→ Bond

→ Italia Big Cap

→ Italia Mid Cap

→ Master Balanced

→ Master Puro

→ Megatrend

→ US Selection

Report

Nota Tecnica Settimanale

Weekly note that provides a comprehensive update on the situation of the main markets, with insights for situations of particular interest or importance.

The report contains also:

* the indications of the FORECASTER: a quantitative model that analyzes the structure of the underlying asset through a statistical combination of the cyclical positions calculated over different time frames. The FORECASTER offers an objective evaluation of current profitability and also an analysis of the prospective profitability.

* the indications of the CRYPTORAIDER REPORT: the first quantitative report on cryptocurrencies in Italy that follows the evolution of the main cryptocurrencies with the automated indications of the models.

The note is published over the weekend, with market closed, to allow Users to plan their operational activity.

The report is accompanied by the Table of Levels, which is published on the first operating day of the week and contains the update on the main instruments (indices, ETFs, bonds, commodities, currencies, Italy MIB + Mid and Small Caps ES50, Switzerland and USA) .

Monthly Report

The report is published within the first half of each month and includes the following sections:

* Technical Comment

* Forecaster

* Cyclical Scenario

* Performance

* Macro Outlook

* Economic Indicators

* Prospective Indicators Table

* 7 years Cycle

* 4 years Cycle (presidential)

* Strategies

* Cycles and rating of Europe/Italy/USA + Bonds/Commodities

* Volatility

* Projections

Tools

Portfolio Tracker

Motore Grafico

Tabelle Operative

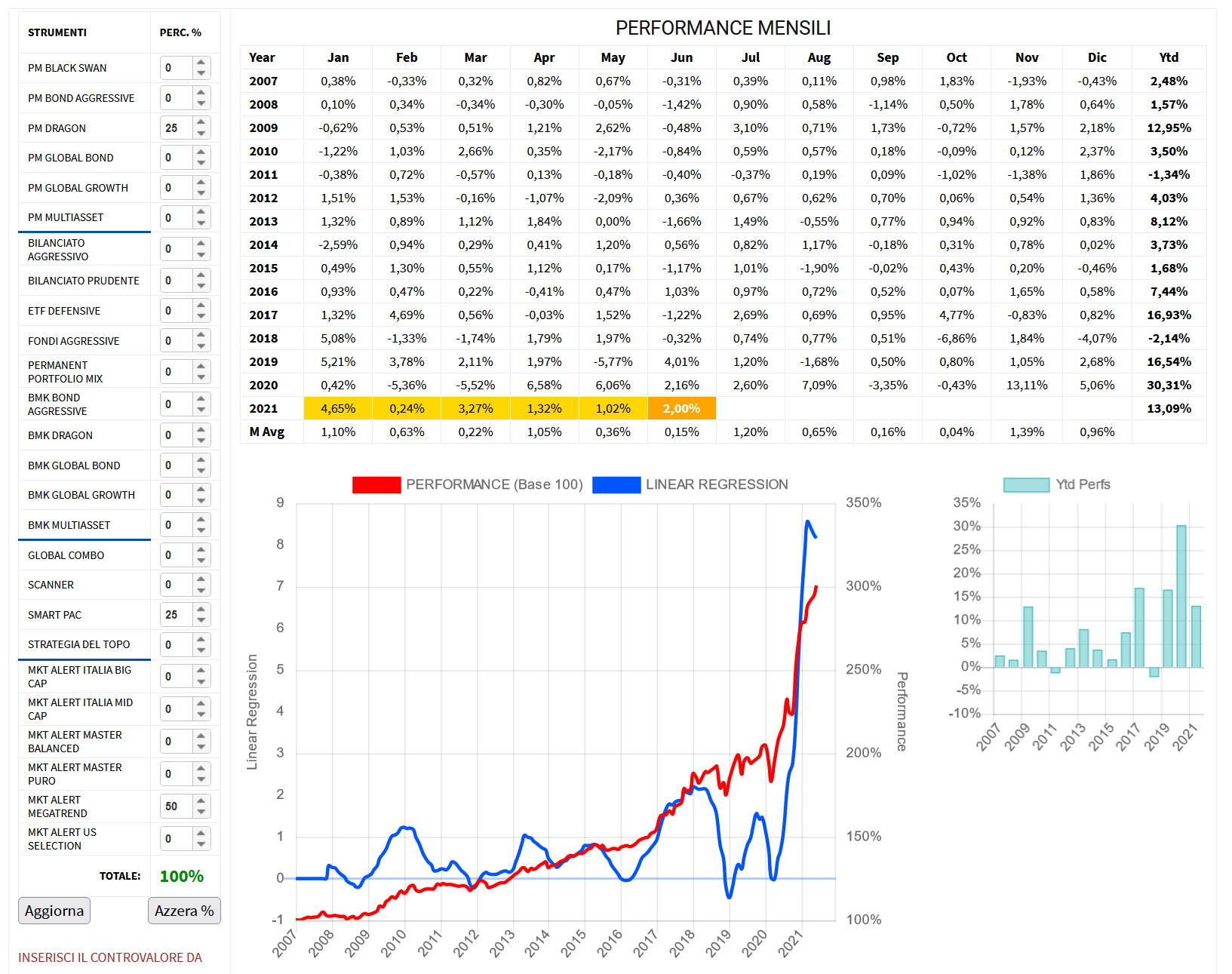

Interactive engine which allows you to build and simulate your own portfolio choosing from all the proprietary strategies.

In addition, the Portfolio Tracker offers the possibility to see the historical data of the chosen combination and/or of each individual portfolio and a series of statistics that help in identifying the combination. It is possible to save the selected asset allocation in Excel complete with instruments, ISIN and percentage weights and invested capital.

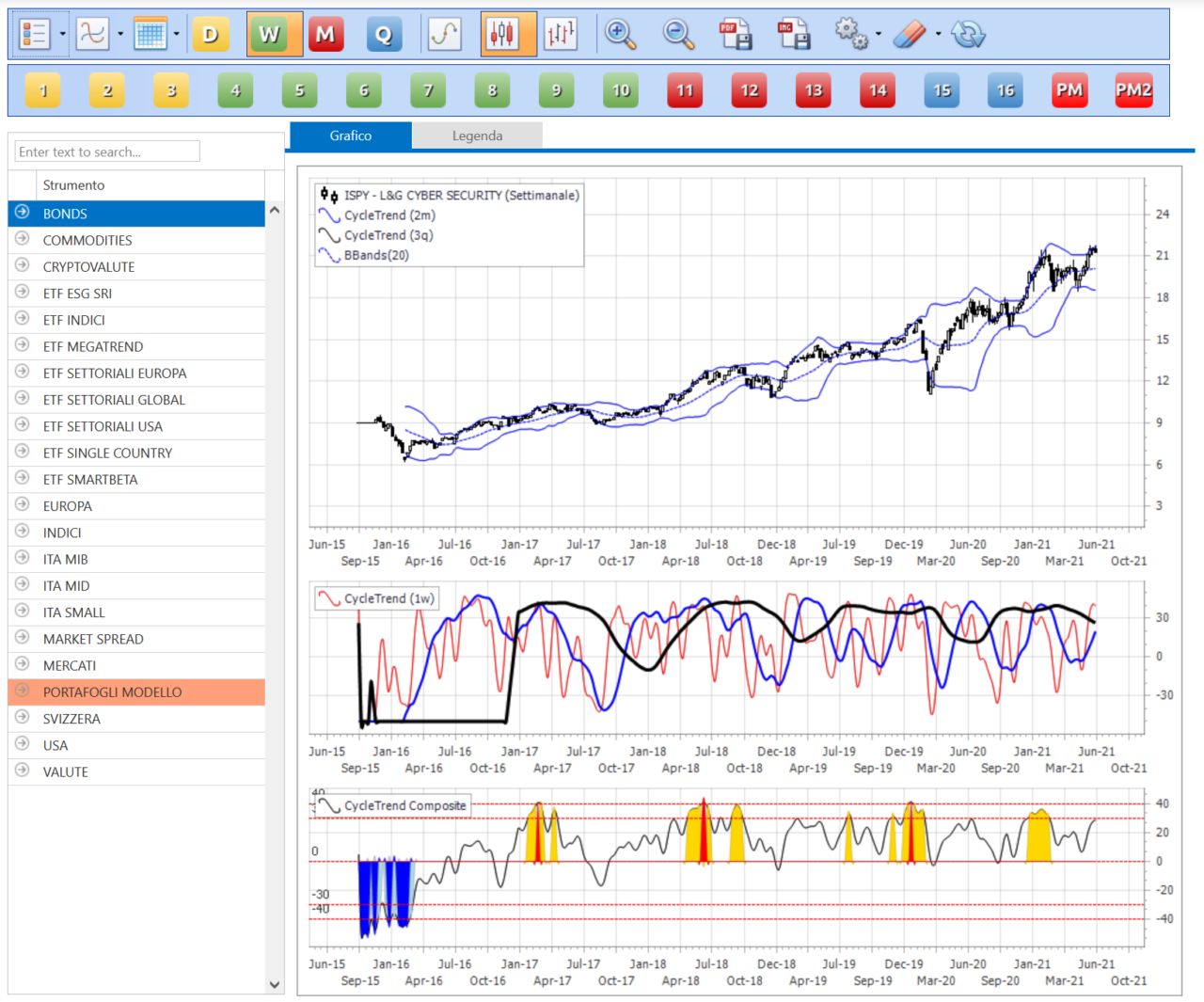

Over 800 tools and over 30 indicators to independently analyze the technical part of the markets. Indices, ETFs, stocks, currencies, commodities and the main classic indicators of Technical Analysis, but above all the proprietary indicators of Cicli&Mercati including: Composite Momentum Oscillator (CMO), Fear/Greed Index, Investitore Disciplinato (ID), Thermic Indicator, C-Wave, Trigger and Heisenberg.

The Motore Grafico is equipped with daily, weekly, monthly and quarterly data, with linear display charts, bar charts and candlesticks and 14 pre-set display templates.

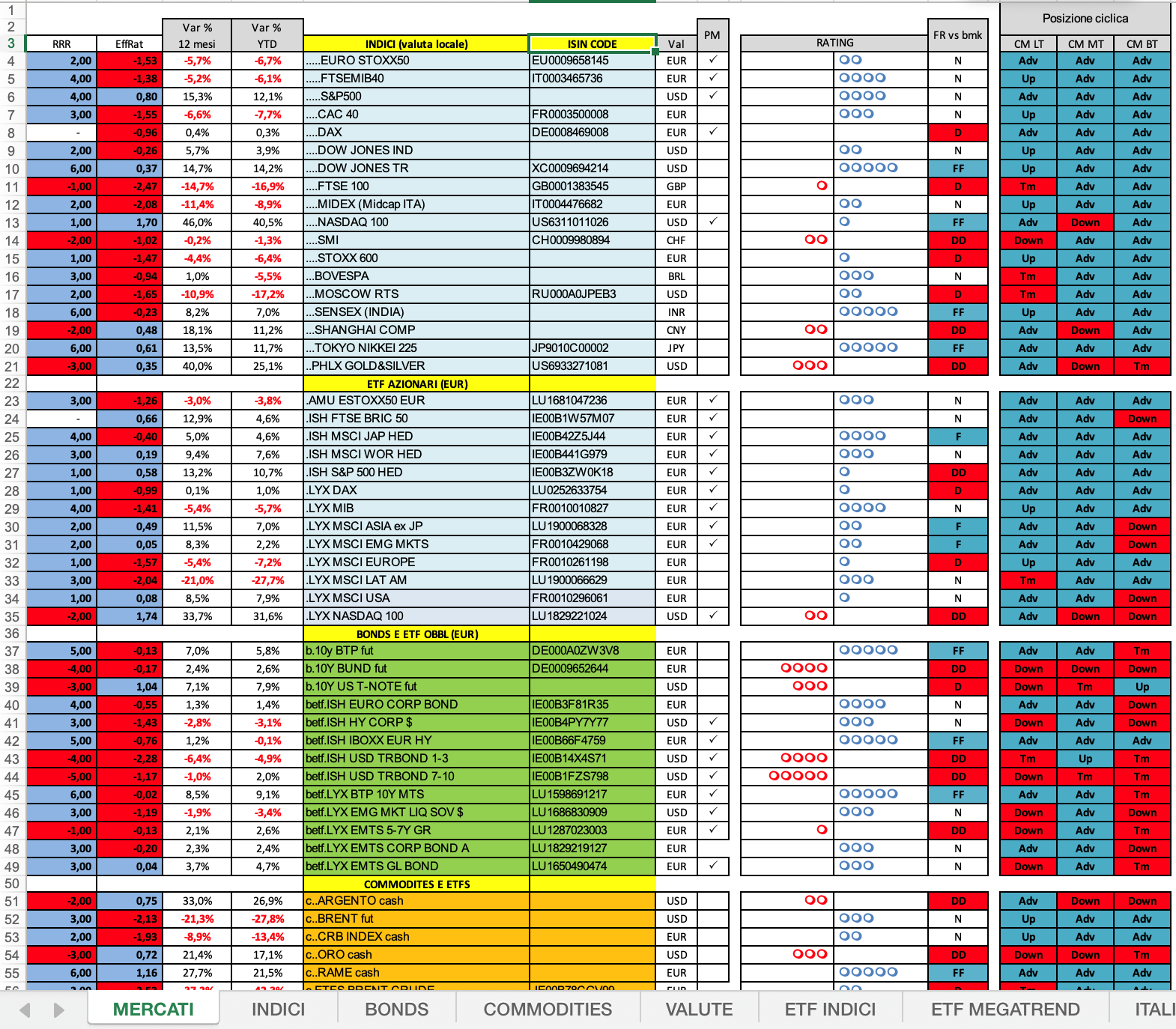

Monthly snapshot aimed at displaying the technical ratings, cyclical position, potentialand risksof each asset: stock, sector, index, ETF, currency etc. Everything is structured by our proprietary algorithm, not a single syllable or number of these tables is entered manually.

Available for online consultation and in downloadable Excel format.

Portfolio Tracker

Interactive engine which allows you to build and simulate your own portfolio choosing from all the proprietary strategies.

In addition, the Portfolio Tracker offers the possibility to see the historical data of the chosen combination and/or of each individual portfolio and a series of statistics that help in identifying the combination. It is possible to save the selected asset allocation in Excel complete with instruments, ISIN and percentage weights and invested capital.

Motore Grafico

Over 800 tools and over 30 indicators to independently analyze the technical part of the markets. Indices, ETFs, stocks, currencies, commodities and the main classic indicators of Technical Analysis, but above all the proprietary indicators of Cicli&Mercati including: Composite Momentum Oscillator (CMO), Fear/Greed Index, Investitore Disciplinato (ID), Thermic Indicator, C-Wave, Trigger and Heisenberg.

The Motore Grafico is equipped with daily, weekly, monthly and quarterly data, with linear display charts, bar charts and candlesticks and 14 pre-set display templates.

Tabelle Operative

Monthly snapshot aimed at displaying the technical ratings, cyclical position, potentialand risksof each asset: stock, sector, index, ETF, currency etc. Everything is structured by our proprietary algorithm, not a single syllable or number of these tables is entered manually.

Available for online consultation and in downloadable Excel format.